J.P. Morgan’s JPMD isn’t just another stable coin but a strategic move to re-intermediate DeFi from the inside out.

Stablecoins like USDC and USDT have powered blockchain transactions and DeFi, but because they’re issued by non-bank entities, institutions hesitate due to compliance, insurance, and trust challenges.

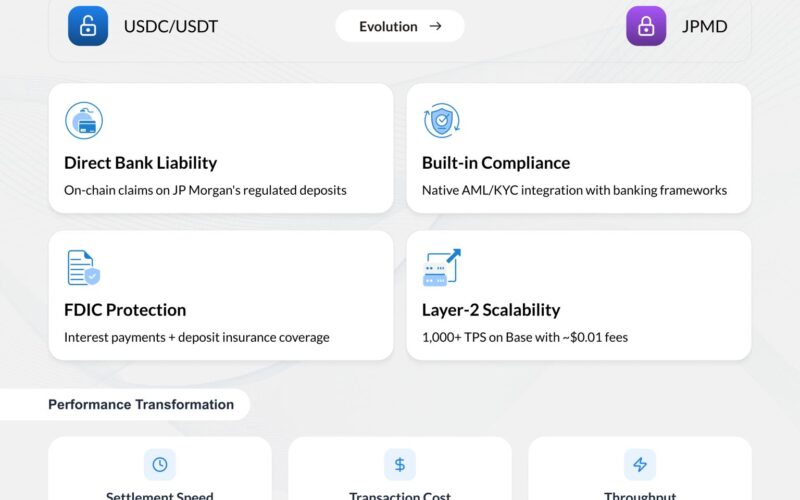

Deposit Tokens: The Evolution Beyond Stablecoins

Deposit tokens like JPMD represent a key evolution. Here’s how they improve on stablecoins:

-

Direct bank liability: JPMD tokens are on-chain digital claims on J.P. Morgan’s fractional reserve deposits, fully regulated and insured under bank supervision.

-

Built-in regulatory compliance: Designed to integrate seamlessly with banking frameworks, treasury systems, and automated AML/KYC processes, reducing compliance friction.

-

Interest and deposit insurance: Unlike standard stablecoins, deposit tokens can support interest payments and benefit from FDIC-equivalent insurance protections.

-

Layer-2 deployment for scalability: JPMD runs on Ethereum Layer-2 solutions like Base, leveraging Ethereum’s security with transaction throughput above 1,000 TPS and low fees (~$0.01), suitable for high-frequency institutional settlements.

Real-World Benefits

This setup enables real-world benefits. Large institutions can settle tokenized securities and B2B payments on-chain using bank-backed digital cash, reducing reconciliation delays and counterparty risk.

It creates programmable, regulated money enterprises can trust from day one.

Why the Timing Matters

The timing is also critical… why?

-

Layer-2 scaling solutions have matured

-

Regulatory frameworks are clearer

-

Banks are shifting from resisting DeFi to integrating its capabilities

-

Hybrid systems with open rails and regulated issuance are emerging