Because putting trusted assets on trusted rails is the next logical step.

We’re talking about a $16 trillion market that still depends on aging infrastructure, manual clearing, siloed systems, and settlement delays.

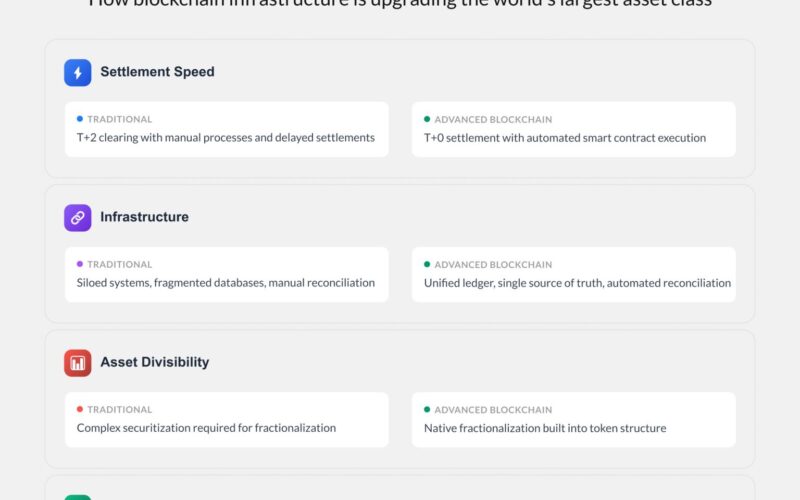

Tokenization Doesn’t Change the Asset; It Changes the Process

A Treasury bond is still a Treasury bond. What changes is how it’s issued, settled, and managed.

Instead of manual clearing, fragmented databases, and delayed settlements, tokenization provides a single digital wrapper that’s programmable, transparent, and globally accessible.

On-Chain Representation Unlocks Key Advantages

On-chain representation turns the bond into a programmable financial object, enabling system-level benefits:

-

Settlement logic moves on-chain – T+2 clearing becomes T+0, reducing counterparty and settlement risk.

-

Smart contracts encode lifecycle actions – interest payments, redemptions, and compliance triggers execute automatically without human intervention.

-

Fractionalization is native – bonds can be split into smaller units without separate securitization processes.

-

Ledger is unified – instead of reconciling across 4–5 entities, all transactions live on a shared, timestamped ledger.

-

Custody becomes abstracted – ownership is cryptographically secured, and transferability is built into the token.

What This Means in Practice

-

Automate actions like interest payments or redemptions

-

Offer assets in smaller, more accessible units.

-

Settle transactions in minutes, not days.

-

Keep an immutable audit trail within the asset itself

Not a Replacement, An Upgrade to Financial Plumbing

This isn’t about replacing traditional finance. It’s about making the financial infrastructure work better, especially at scale.

BlackRock isn’t experimenting. They’re laying the groundwork for how $16 trillion in real-world assets will move in the future.

Feels niche today, but this is how capital markets get upgraded.