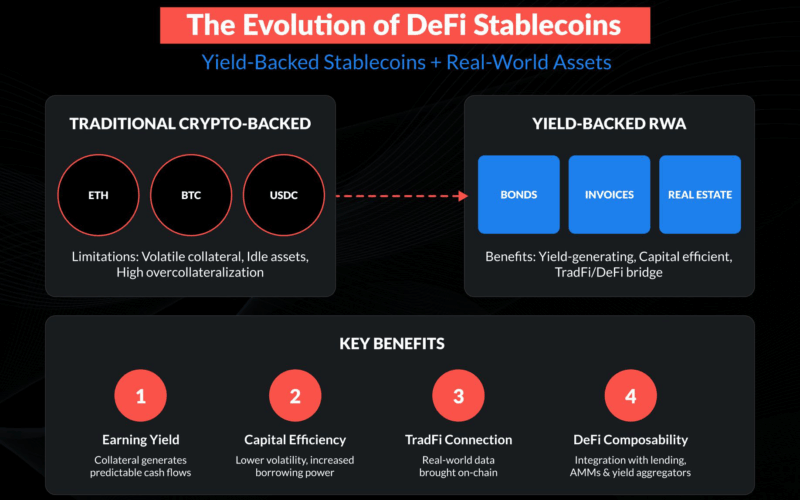

I’ve been looking into how DeFi stablecoins are evolving. Traditionally, stablecoins rely on crypto collateral, which is volatile assets like ETH or USDC. These limits yield and can cause instability.

Now, a new approach is emerging where stablecoins are backed by real-world assets (RWAs) that generate steady yield, like bonds, invoices, or real estate.

What Makes This Shift Interesting

-

Collateral that earns yield: Instead of just sitting idle, these assets produce predictable cash flows (e.g., bond interest), which can be factored into the stablecoin’s stability mechanisms.

-

Better capital efficiency: Real-world assets tend to be less volatile than crypto, allowing protocols to safely reduce overcollateralization and increase borrowing power.

-

Connecting traditional finance and DeFi: Token standards and oracles bring reliable real-world data on-chain, like asset performance and credit risk, enabling more automated and transparent risk management.

-

DeFi composability: These yield-backed stablecoins plug into lending, AMMs, and yield aggregators, helping build richer financial products.

Why Does This Matter Now?

Because DeFi infrastructure and regulatory clarity have reached a point where integrating real-world assets is practical and scalable.

This opens the door to more stable, yield-generating options that appeal to both builders and users.

From my perspective, yield-backed RWAs represent a meaningful next step in DeFi protocol design and capital efficiency.

What challenges or opportunities do you see when working with real-world assets or yield-backed stablecoins? Comment your thoughts below…