For years, crypto lived in a world apart from traditional finance.

But there’s a quiet yet massive shift happening in digital finance. Governments are testing Central Bank Digital Currencies (CBDCs). Stripe just announced its stablecoin. And banks? They’re no longer ignoring blockchain… they’re actively integrating it.

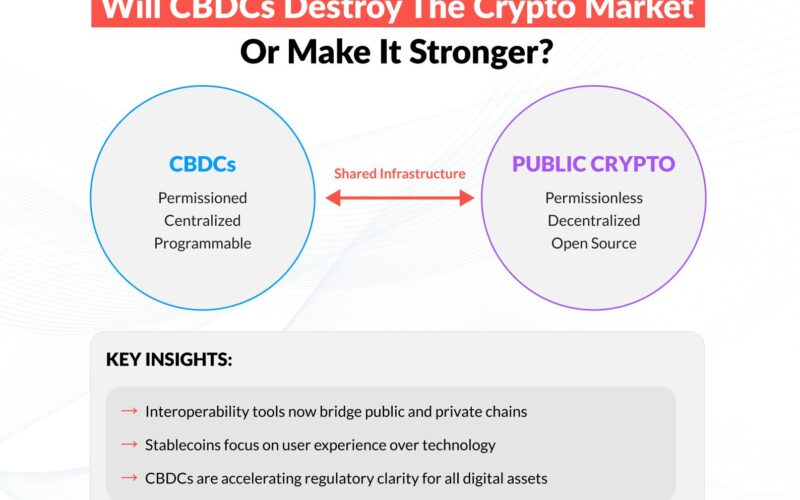

CBDCs ≠ Public Crypto

But here’s the subtle difference that most people miss:

CBDCs are permissioned, centralized, and programmable.

That’s very different from USDC, DAI, or BTC. Yet both systems, CBDCs and public crypto, can run on the same underlying infrastructure: wallets, smart contracts, and Layer 2 networks.

Key Question for Devs and Builders

Are CBDCs a threat to decentralized finance… or the reason it’ll go mainstream?

What’s Happening Right Now

→ Interoperability matters more than ever

Tools like CCIP and Fireblocks are bridging public and private chains, crucial for CBDCs to coexist with crypto.

→ Stablecoins are all about UX now

With Stripe, PayPal, and Circle in the game, the coin matters less than the tools and experience around it.

→ CBDCs are forcing clearer rules

Governments piloting digital currencies are defining what’s legal, which benefits crypto builders too.

Who Gains and Who Adapts?

-

Fintech builders can now plug into both public and private digital rails. Crypto apps may need to evolve to support state-issued assets.

-

Developers get new primitives: programmable CBDCs, hybrid wallets, and policy-aware contracts.

-

Users get faster payments with legal clarity — but possibly less privacy.

What’s your take on CBDCs and Stablecoins? Comment your thoughts below…