Blockchain is no longer a theory waiting for adoption. It’s becoming practical infrastructure for industries that once only watched from the sidelines.

We’ve moved past the hype cycle… the inflated expectations, the speculative chaos, and the disillusionment that followed. What’s emerging now is a more grounded reality where blockchain is a business tool.

A Shift from Debate to Deployment

We’re not debating decentralization principles or hyping protocols anymore. We’re talking about real-world use cases, measurable ROI, and strategic integration.

Institutional moves underscore this shift. The approval of spot Bitcoin ETFs in the U.S. marked a clear transition. What followed was deeper:

-

JPMorgan processing tokenized settlements

-

BlackRock pushing tokenized funds

-

Regulators leaning in to provide clarity, not resistance

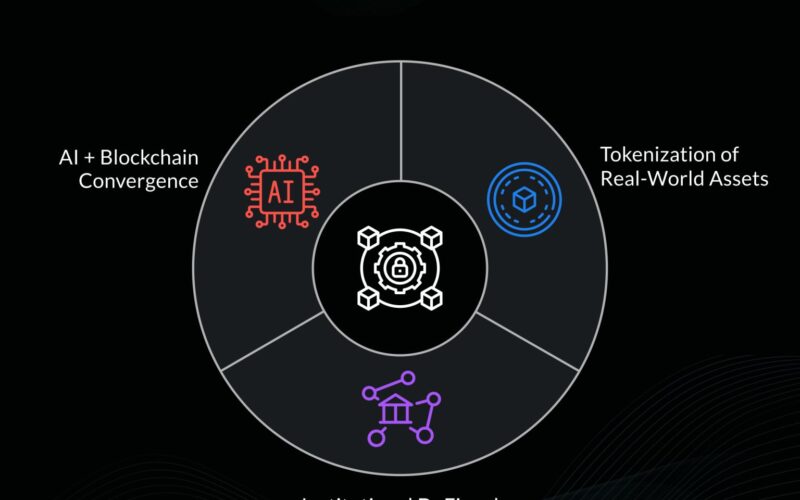

The Three Core Areas Defining Blockchain’s New Phase

Today, three core areas define this new, pragmatic phase of blockchain:

-

AI + Blockchain convergence: Automating workflows in trusted, auditable environments not theoretical, but deployed.

-

Tokenization of real-world assets: From treasuries to real estate, we’re seeing digitization with clear compliance frameworks.

-

Institutional DeFi and deposit tokens: Not replacing the financial system, but upgrading it with programmable money and more efficient rails.

Reinforced by Regulation and Security

All of this is reinforced by regulatory maturity and stronger security baselines.

-

MiCA is becoming operational

-

ZK-proofs are being implemented beyond academic papers

Where are you seeing blockchain actually deliver value, beyond the whitepapers?