The Fragmentation Problem in Web3 Finance

Right now, Web3 finance runs on fragmented infrastructure. That’s the problem holding everything back.

In the past few weeks, I’ve been spending time looking at the infrastructure side of Web3 finance. The technology is evolving fast, but when you zoom out, a recurring gap becomes very clear.

Most of Web3 doesn’t fail because of lack of innovation. It struggles because the rails aren’t integrated.

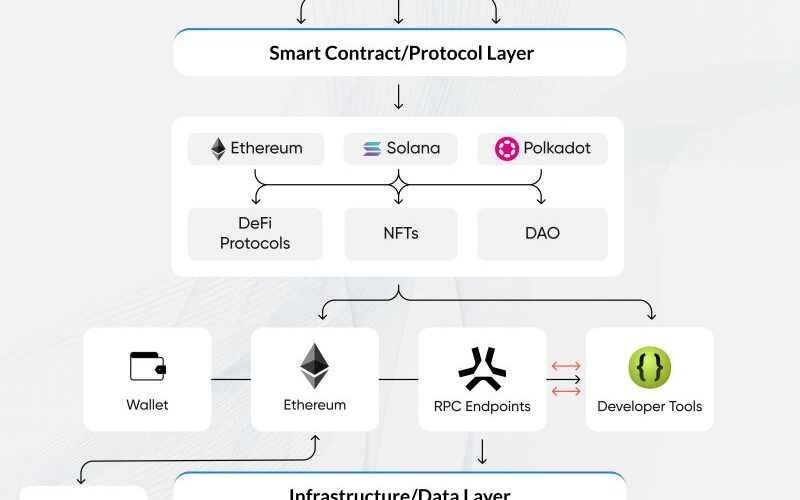

Today, the stack feels stitched together. We rely on:

-

Exchanges for liquidity

-

Wallets for custody

-

Bridges for interoperability

-

DeFi apps for yield

-

Fiat gateways for conversion

Each of these components works reasonably well on its own, but there is very little connective tissue that makes them operate seamlessly as one system. The result is friction at almost every step of the user and developer journey.

How Fragmentation Shows Up in Web3 Finance

On/Off Ramps

On/Off Ramps remain clunky, compliance-heavy, and inconsistent across regions, which makes fiat conversion slow and costly.

Interoperability

Interoperability is mostly handled through fragile bridges, which are both a security risk and a poor substitute for reliable standards.

Payments

Payments still lack the predictability and smoothness of established systems like UPI or card networks, creating gaps for real-world adoption.

Risk and Compliance

Risk and Compliance are treated as isolated add-ons. This forces teams to repeatedly rebuild the same layers instead of extending a shared foundation.

Lessons from the Early Internet

It feels similar to the early internet, where many local networks existed but TCP/IP hadn’t yet standardized communication. Once that connective layer emerged, the ecosystem could scale.

The Path Forward: Building Integrated Web3 Rails

The same principle applies here. Building integrated rails for Web3 is not about reinventing every individual layer. It is about designing standards that unify liquidity, compliance, and interoperability without introducing new points of failure.